search for solutions by category, industries, insights, and people.

In construction, where margins are tight and competition is fierce, contractors can no longer rely on gut instinct or legacy relationships alone. Winning work and keeping it profitable requires a data-driven strategy. That strategy starts with benchmarking and key performance indicators (KPIs).

Real-time KPI dashboards allow stakeholders to assess operational efficiency and financial health. These metrics help measure progress, align teams around shared priorities, and demonstrate value to clients and bonding companies. However, KPIs are only as good as the data behind them. If your data is unreliable or untimely, your decisions will be too.

In this article, we explore how contractors can use benchmarking and KPIs to sharpen their bids and improve margins.

Benchmarking empowers contractors to make smarter, data-driven decisions by comparing performance against industry standards, competitors, or internal historical data. It helps answer important questions like: Are we bidding competitively? Are we managing cash flow effectively? Are we operating as efficiently as we think?

Since contractors tend to be highly competitive, benchmarking naturally appeals to them, providing meaningful comparisons and insights that reveal strengths, expose weaknesses, and guide continuous improvement. There are three primary types of benchmarking to consider:

Incorporating post-project reviews into your benchmarking process adds another layer of insight, helping teams pinpoint what worked, what didn’t, and how to improve outcomes in future projects.

Begin with a few high-impact KPIs and expand as your data maturity grows. Focus on metrics that have the biggest financial impact, such as labor costs, overhead and indirect costs, material costs, cash flow, and project timelines.

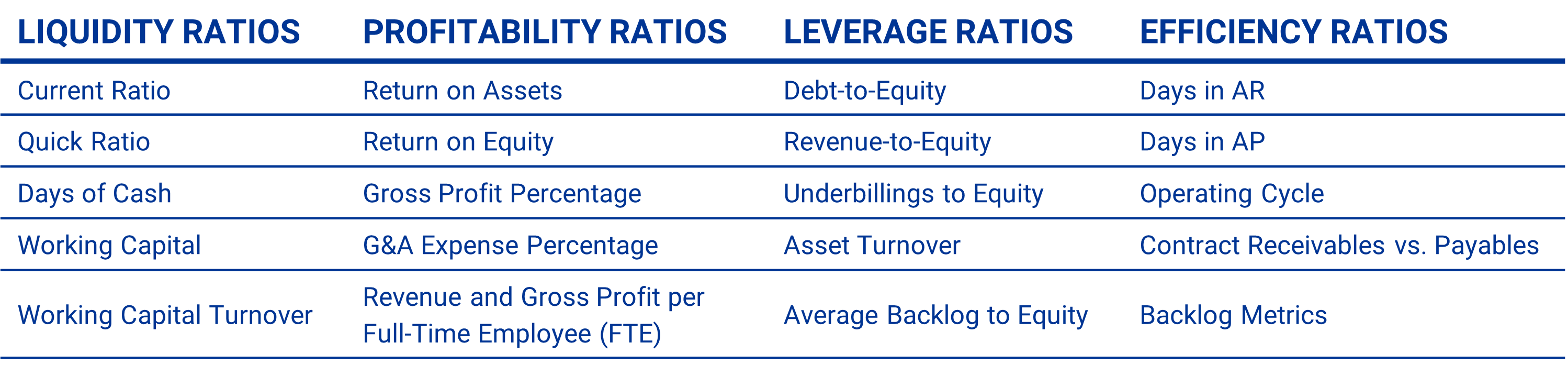

Some common construction industry KPIs include:

Use dashboards to visualize performance and track financial ratios like current ratio, quick ratio, and working capital. This helps identify cash flow issues before they erode margins.

Caution: Interpreting KPIs without context leads to flawed conclusions. For example, a low equity ratio might be justified by a year-end distribution or strategic reinvestment. Contractors must understand the “why” behind the numbers, especially in the middle market, where financial sophistication varies.

KPIs vary by sector, size, location, seasonality, and strategic goals. For example, contractors scaling up should focus on efficiency and cash flow, while those preparing for a sale or succession should prioritize profitability and leverage. If reinvesting capital, tighter performance ratios are expected.

To use KPIs effectively, contractors should connect them to relevant benchmarks, choose benchmarking peers in the top quartile or those facing similar challenges, conduct post-project reviews, and leverage data to predict and mitigate risks. This enables contractors to:

Contractors gain a competitive edge when they treat KPIs as dynamic, evolving elements of their business strategy. When these indicators are aligned with strategic intent and grounded in reliable data, they become powerful tools for driving growth, enhancing margins, and building long-term resilience.

To protect healthy margins and secure or maintain bonding capacity, contractors must stay vigilant about key financial warning signs. These indicators often point to underlying issues that, if left unaddressed, can erode profitability and jeopardize long-term stability.

Common red flags include:

Routine monitoring for these red flags helps contractors catch and resolve problems early, make informed decisions, and maintain credibility with lenders, bonding companies, and stakeholders.

Caution: A mismatch between backlog and equity, such as a $150 million backlog with only $3 million in equity, will raise concerns for bonding companies and potentially limit growth.

The ratios you prioritize should reflect your current business objectives—whether you're scaling, preparing for sale or succession, or reinvesting capital.

Below are key categories and examples of ratios commonly used in the construction industry:

Frequency matters. Liquidity ratios may be reviewed weekly, while leverage and efficiency ratios are best assessed quarterly or semi-annually to evaluate long-term stability and operational effectiveness.

Strategy directs focus. If you’re preparing for a sale or succession, prioritize profitability and leverage ratios. If you’re scaling, focus on efficiency and cash flow.

Ready to see how your business stacks up against the competition? Contact our Construction team to run a benchmarking report and analyze your current KPIs. Let’s turn your data into decisions and your decisions into wins.

For more insights, check out our related article on cash flow tips in construction.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.