search for solutions by category, industries, insights, and people.

Accounting Today

Accounting Today

Southeast’s fastest growing hubs as well as Bengaluru, India

Alternative investments continue to gain momentum in 2026 as investors seek diversification, differentiated return characteristics, and protection against concentration in the public market. Once dominated almost exclusively by large institutional investors and ultra-high net worth individuals, the space has become a core component of modern portfolio construction.

Broadly defined, alternative investments include asset classes outside publicly traded stocks and bonds. These differentiated and often uncorrelated return profiles appeal to investors looking to diversify risk. Private markets are now approaching $20 trillion globally, drawing increased participation from both institutional and individual investors.

This outlook examines four segments driving allocation decisions this year: private equity, venture capital, hedge funds, and private credit.

Key expectations for 2026:

Private equity spans investments in privately held companies through leveraged buyouts, growth equity, and operational transformation. After years of stalled exits and elevated borrowing costs, dealmaking is gaining traction and liquidity pathways are reopening. Yet the recovery is uneven and selective, with capital concentrating among the largest managers.

PitchBook estimates the top ten private equity funds will capture more than 40% of all fundraising, intensifying challenges for emerging and mid-market general partners (GPs). Lower rates are improving leverage capacity and deal feasibility, with middle market loan costs down 3 percentage points from recent peaks. If the Fed continues cutting rates, return profiles could strengthen further, according to analysts cited by Morgan Stanley.

Technology, industrials, and insurance remain key areas of focus as investors turn toward platforms built around operational transformation rather than multiple expansion.

Key expectations for 2026:

Venture capital provides equity financing to early stage, high growth companies, particularly in AI, biotech, and climate tech. After two years of tight capital and weak exits, liquidity is improving and M&A markets are reopening.

Global M&A volumes surged in late 2025, with Q3 deal volume up 40% year over year. Lower financing costs and stabilizing rate expectations may further support activity through 2026.

Industry analyses consistently identify AI as a primary driver of investment activity. By Q3 2025, AI startups captured 65% of all venture capital deal value, and more than half of new unicorns were AI driven. PitchBook expects AI investment to expand into biotech, climate tech, fintech, and other innovation heavy sectors.

Key expectations for 2026:

Private credit (non bank lending to middle market, opportunistic, distressed, and asset backed borrowers) remains one of the fastest growing alternative segments. Expansion is being driven by tighter bank capital standards, evolving lending practices, and borrowers’ increased need for customized financing solutions.

Moody’s predicts private credit assets under management (AUM) will exceed $2 trillion in 2026, fueled by significant capital commitment from global cloud and technology providers. Their multiyear investment in data centers and digital infrastructure is resulting in increased demand for financing, fueling growth in asset backed and structured lending activity.

As the asset class expands, regulators are paying closer attention. Initiatives like the Bank of England’s 2026 exploratory review of private markets reflect concerns around a growing correlation with traditional finance and increased retail investor participation.

Key expectations for 2026 (based on industry research from Barclays, S&P Global, and BNP Paribas):

Hedge funds, using long/short, arbitrage, macro, and multi strategy approaches, enter the year with renewed momentum. After several years of mixed results, performance is stabilizing and dispersion is widening. Rising investor demand, combined with a macro environment favoring active management, supported strong results in 2025 and sets a constructive backdrop for the year ahead.

The industry continues to outpace cash returns, earning about 10.5% in 2025 and nearly 8% annually over the past five years. AUM are projected to reach $5 trillion by the end of 2027.

Alternative investment firms have significant room to grow in 2026. Those that stay ahead of regulatory shifts, global uncertainty, and market dynamics will be better positioned to attract capital and scale effectively.

Our team supports clients with:

Let’s discuss how we can support your firm.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.

.jpg)

In this edition of the quarterly communication, we have provided information about financial reporting and accounting issues – some of which are currently being evaluated by regulatory agencies and not resolved at this time. We have also compiled a list of items for consideration in your financial reporting and disclosures for the fourth quarter and a summary of recently issued accounting pronouncements (see Appendices for summary of recently issued accounting pronouncements and the related effective dates).

Click here to download the PDF.

The following selected Accounting Standards Updates (ASUs) were issued by the Financial Accounting Standards Board (FASB) during the fourth quarter. A complete list of all ASUs issued or effective in 2025 is included in Appendix A.

In November, the FASB released ASU 2025-08, Financial Instruments—Credit Losses (Topic 326): Purchased Loans, introducing significant changes to the Current Expected Credit Loss (CECL) standard. This update aims to enhance comparability and consistency in acquisition reporting.

The amendments apply to all entities subject to Topic 326 guidance, including public and private businesses and not-for-profit organizations. Key provisions include:

Effective Dates

Annual periods beginning after December 15, 2026, including interim periods. Early adoption permitted. Implementation is prospective for loans acquired on or after the adoption date.

In November, the FASB released ASU 2025-09, Derivatives and Hedging (Topic 815): Hedge Accounting Improvements to better align hedge accounting with risk management strategies and address reference rate reform issues.

The guidance applies to all entities electing hedge accounting in accordance with U.S. GAAP. Key provisions include:

Effective Dates

For public business entities, the effective date is for annual periods beginning after December 15, 2026. For all other entities, it begins after December 15, 2027. Early adoption is permitted. Implementation is prospective.

In December, the FASB issued ASU 2025-10, Accounting for Government Grants Received by Business Entities, that establishes authoritative guidance on the accounting for government grants received by business entities.

The amendments apply to all business entities except for not-for-profit entities and employee benefit plans that receive a government grant. Key provisions include:

Effective Dates

For public business entities, the effective date is for annual periods beginning after December 15, 2028, including interim periods within those years. For all other entities, it begins after December 15, 2029, including interim periods. Early adoption is permitted; interim adoption applies from the start of the annual period.

The ASU allows three transition approaches: modified prospective, modified retrospective, or full retrospective. Under the modified prospective approach, prior periods are not restated, and no cumulative-effective adjustment is required. The modified retrospective and full retrospective approaches require restating prior periods and applying a cumulative-effect adjustment to opening retained earnings.

In December, the FASB released ASU 2025-11, Interim Reporting (Topic 270): Narrow-Scope Improvements. The update reorganizes guidance for interim reporting without altering its nature or scope. The ASU confirms that Topic 270 applies to all entities that issue interim financial statements under GAAP.

Key Changes

Effective Dates

On November 25, 2025, the FDIC issued a final rule, raising asset thresholds for certain regulatory requirements to better reflect inflation and reduce burdens on community banks.

Threshold Increases

Inflation Indexing

Future adjustments to the thresholds will be tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), with adjustments occurring every two years.

Effective Dates

These changes took effect January 1, 2026. Institutions that fall below the new thresholds as of that date are not required to meet the previous Part 363 requirements for year-end 2025 reporting—providing immediate relief. Future inflationary adjustments will occur October 1 of the adjustment year.

On November 24, 2025, the FDIC released its most recent Quarterly Banking Profile covering the third quarter of 2025. The Quarterly Banking Profile provides the earliest comprehensive summary of financial results for all FDIC-insured institutions. The report includes data from 4,379 commercial banks. Highlights are included below:

In a December address at the New York Stock Exchange, SEC Chairman Paul Atkins outlined priorities to ease regulatory burdens. Since taking office in April, Atkins has promoted policies favoring cryptocurrency and reducing compliance hurdles for small businesses, arguing that strict rules hinder capital raising.

Atkins urged scaling disclosure requirements by company size and maturity, arguing that decades of growing requirements have made public markets less attractive. He noted that the number of public companies has declined by roughly 40% since the mid-1990s, from over 7,000 to about 4,200, driven by regulatory overreach. Commissioner Mark Uyeda supports revisiting classifications to help smaller firms.

Atkins also called for targeting pay disclosure rules introduced after the 2008 financial crisis, including requiring companies to report the ratio of CEO compensation to median employee compensation. In 2024, S&P 500 CEOs earned an average of $18.9 million, up 7% from 2023, with a pay ratio of 285:1, according to the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO). Critics warn that deregulation and a shrinking workforce could weaken oversight, allowing risks and misconduct to accumulate.

In December, the House passed the Incentivizing New Ventures and Economic Strength Through Capital Formation (INVEST) Act of 2025. The bipartisan bill (H.R. 3383) aims to spur capital formation and ease accounting and reporting requirements for crowdfunded companies and emerging growth companies (EGCs). It includes:

Additional measures ease certain venture fund requirements, expand e-delivery of investor documents, direct the SEC to adjust “small entity” definitions, broad the accredited investor definition, increase the eligibility for well-known seasoned issuer (WKSI) status, and relax testing-the-waters and general solicitation requirements.

Industry groups, including the Securities Industry and Financial Markets Association (SIFMA), backed the INVEST Act as commonsense reforms to expand access, growth, and innovation in U.S. capital markets. However, consumer advocates and unions warned the bill would weaken core protections and undermine market oversight.

On December 17, 2025, the House Financial Services Committee passed H.R. 6541, the Regulation A+ Improvement Act, advancing it for further consideration by the full House. The Act would double the Tier 2 offering cap from $75 million to $150 million, adjusted for inflation every two years. Reg A uses a two-tier system:

The 2012 law originally capped Tier 2 offerings at $50 million, later raised to $75 million in 2020.

On November 25, 2025, the OCC, FDIC, and Fed jointly proposed revising the Community Bank Leverage Ratio (CBLR) to lower the minimum from 9% to 8% and make the statutory minimum permanent. The proposal also extends the grace period for falling out of compliance from two quarters to four quarters, allowing more banks flexibility to lend. Comments are due by January 30, 2026.

On December 1, 2025, the Fed issued its semiannual Supervision and Regulation Report, detailing banking conditions, supervisory activities, and regulatory developments. The report highlights overall system resilience, strong capital positions, and solid loan growth, while noting commercial real estate (CRE) weakness. Recent actions include releasing large bank supervision manuals for transparency, focusing on cyber resilience, and conducting stress tests. Supervisors are closely monitoring exposures to nonbank financial institutions (NBFIs) due to their higher risk appetite and recent defaults.

The Fed updated its bank supervision approach in late 2025, shifting focus to material financial risks over minor process issues and adopting tailored supervision based on bank size and complexity. The changes aim to reduce duplication, rely more on strong internal controls, and deliver more efficient, risk-focused oversight with earlier, proportionate actions.

The OCC released its Fall 2025 Semiannual Risk Perspective, addressing key risks that could affect the safety and soundness of banks and compliance with applicable laws and regulations. The report focuses on four risk themes:

On November 24, 2025, the OCC announced a major package of measures to ease regulatory burdens on community banks (under $30B in assets), including tailored, risk-based BSA/AML exams, discontinuing money laundering risk data collection, and seeking input on core provider challenges. These steps aim to cut unnecessary requirements and boost lending and local economic growth.

In November, the OCC authorized national banks to hold crypto assets on their balance sheets to cover network fees for blockchain transactions, facilitating permissible activities and testing, reducing reliance on third parties, and improving efficiency for services like custody and stablecoin management. This allows for safer, more efficient operations by keeping necessary tokens on hand, with conditions for risk management and de minimis holdings.

In early December, the SEC updated its Financial Reporting Manual to align with previously adopted amendments related to special purpose acquisition companies (SPACs), shell companies, and projections that took effect July 1, 2024.

In October, the OCC and FDIC issued a joint notice of proposed rulemaking to codify the removal of reputation risk from their programs. The proposed rule bars regulators from taking actions based on reputation risk or political, social, or cultural views, and removes such references from FDIC manuals. The comment period is closed, but the rule is not yet final.

In October, the OCC issued guidance to reduce regulatory burden for community banks by tailoring examination procedures and model risk management expectations to each bank’s risk profile. These actions aim to maintain safety and soundness while allowing banks to focus on serving their communities and supporting economic growth.

Investment analysts advising the FASB recently cautioned that stablecoins remain too risky and unregulated to be considered cash equivalents, despite a growing push to classify them as such. The warning came during a public session of the FASB's Investor Advisory Committee (IAC) in November, where members voiced concerns over high leverage ratios, insufficient regulatory oversight, and potential liquidity strain in the stablecoin market. The discussion is part of a broader FASB project examining how digital assets, including stablecoins, should be classified under U.S. GAAP.

Added to the FASB's technical agenda in October, the project aims to clarify how stablecoins and similar digital assets should appear on financial statements. Rather than creating new categories, the board is considering adding examples to existing U.S. GAAP to guide when digital assets should be treated like cash. Key criteria include direct redemption for cash and full backing by real assets. FASB staff are researching features that qualify a stablecoin as a “cash equivalent,” examining tokenized deposits, addressing “de-pegging” risks (loss of stable value), and defining necessary investor disclosures.

The following selected FASB proposed ASUs, exposure drafts and projects were either newly introduced or updated as well as activities of the EITF and PPC during the quarter ended December 31, 2025.

The Emerging Issues Task Force (EITF) did not meet during the fourth quarter. The next meeting is scheduled for March 12, 2026.

The Private Company Council (PCC) met on September 25 and September 26, 2025. Below is a summary of topics discussed by PCC and FASB members at the meeting:

PCC Agenda Priorities: The PCC discussed research on three topics it had requested further research on, as part of its current agenda prioritization process: (1) lease accounting simplifications, (2) subjective acceleration clauses, and (3) interest method and determining the effective interest rate.

Update on Selected FASB Research Agenda Projects: FASB staff updated the PCC on selected research projects, highlighting (1) research conducted and feedback received, including private-company-specific feedback, (2) how prior PCC feedback was considered by the Board, and (3) recent Board discussions. PCC members provided additional feedback on those selected projects.

Update on Selected FASB Technical Agenda Projects: FASB staff updated the PCC on selected projects, including how prior PCC feedback was considered by the Board. PCC members had the opportunity to provide additional feedback on those selected projects.

Update on Recently Issued Standards: FASB staff highlighted the following recently issued standards, noting the relevance of those standards to private companies:

Town Hall/Liaison Meeting Update:

Other Business: FASB staff provided an update on the FASB Research project, Digital Assets

The following table contains significant implementation dates and deadlines for standards issued by the FASB and others. View Appendix A.

The illustrative disclosures linked are presented in plain English. Please review each disclosure for its applicability to your organization and the need for disclosure in your organization’s financial statements. For the items listed, the Company does not expect these amendments to have a material effect on its financial statements. Other accounting standards issued or proposed by the FASB or similar bodies are likewise not expected to have a material impact on the Company’s financial position, results of operations, or cash flows. View Appendix B.

Note: The disclosures in the previous appendix are not intended to be all inclusive. All pronouncements issued during the period should be evaluated to determine whether they are applicable to your Company. Through September 30, 2025, the FASB has issued the following Accounting Standard Updates during the year. View Appendix C.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.

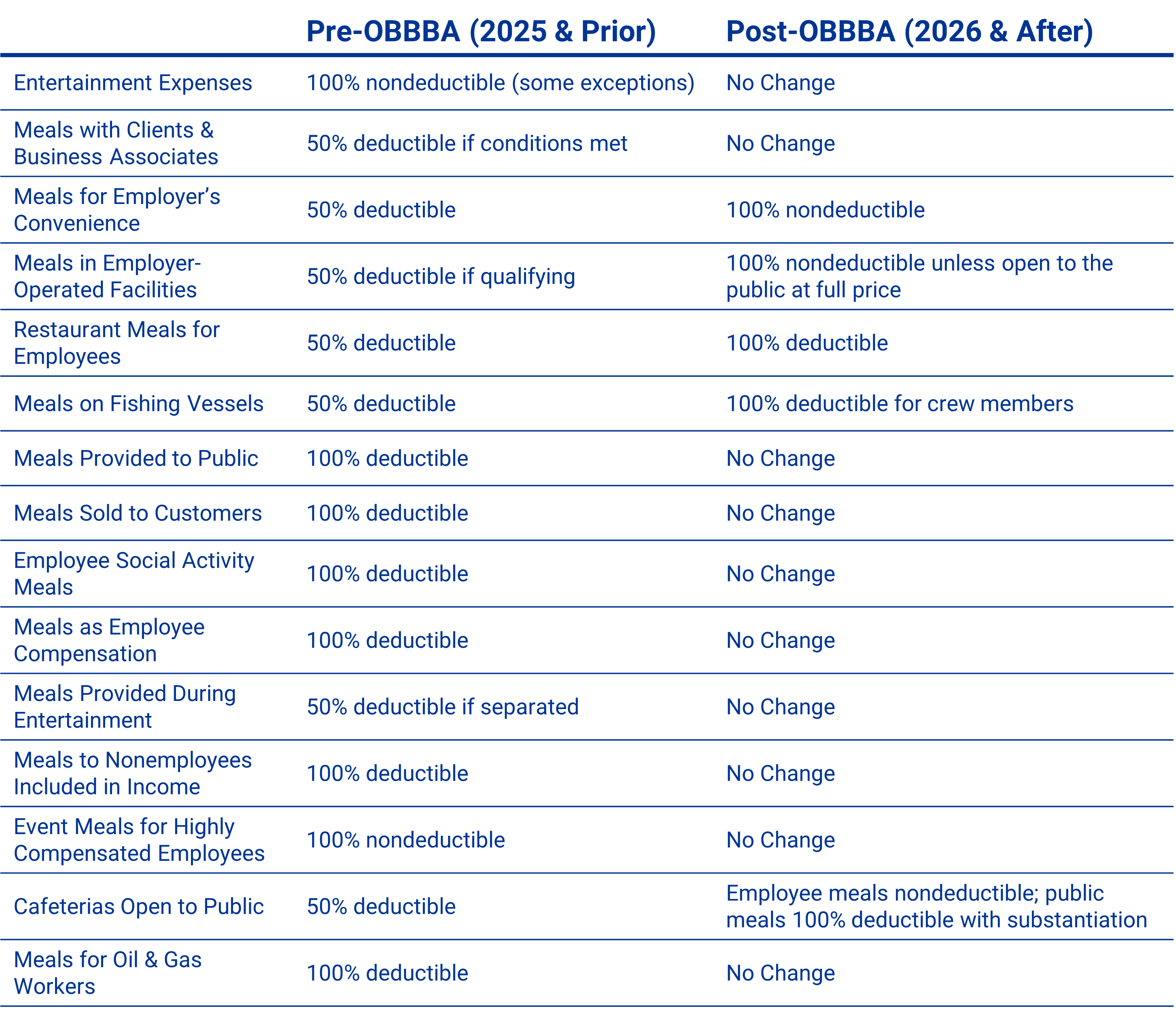

The One Big Beautiful Bill Act (OBBBA) brings new rules for meals and entertainment deductions beginning in tax years after December 31, 2025. While the categories haven’t changed much, the deductibility rules have. For business owners, this means far fewer employer provided meals will qualify. Only a limited set of specific situations will still allow a deduction under the new law.

Below is a table summarizing the changes:

Since the OBBBA significantly limits the deductibility of employer-provided meals, most businesses will need to make some operational and accounting adjustments. As you prepare for the 2026 tax year, consider the following:

The Elliott Davis team helps business owners adapt to the new tax requirements and the strategic decisions that follow. We can assist with policy updates, recordkeeping, and planning so you’re well prepared for the 2026 tax year. Contact us to discuss how these changes may affect your business and what steps to take next.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.