search for solutions by category, industries, insights, and people.

Our recent Financial Services Group webinar explored emerging developments in the financial services industry, including the rise of stablecoins, the impact of the GENIUS Act, changing credit structures, and updated accounting and disclosure requirements.

In the sections that follow, we explore how banks, credit unions, and other financial institutions can strengthen their compliance posture, refine risk modeling approaches, and modernize financial strategies to adapt to new regulatory changes and market dynamics.

Stablecoins are the latest trend in global digital payments and finance. The GENIUS Act of 2025, signed into law on July 18, 2025, legitimizes and defines this type of cryptocurrency, creating a federal regulatory framework on digital assets. Further regulatory guidance is expected in the future.

For a variety of financial services organizations, these developments could impact your competitive position and influence how you prioritize strategic initiatives.

Stablecoins are cryptocurrencies pegged to stable assets like the U.S. dollar, euro, or commodities such as gold. The GENIUS Act further defines payment stablecoins as digital assets used for payments and settlements, backed 100% by liquid reserves, and redeemable for monetary value. They offer instant settlement, low transaction costs, and programmable functionality through smart contracts. Use cases include:

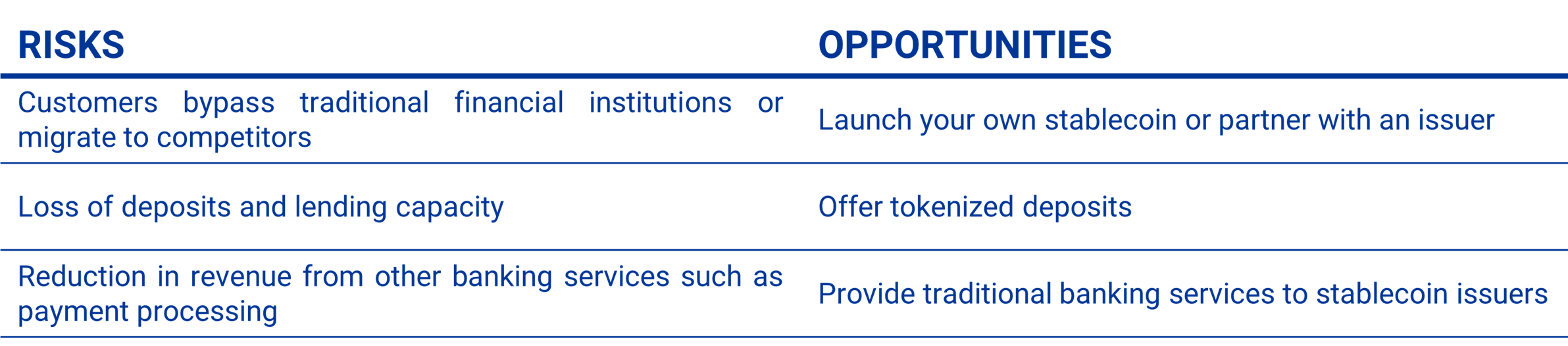

As stablecoins gain traction and regulatory clarity improves, traditional financial institutions face a mix of emerging risks and strategic opportunities that demand close attention and proactive planning.

Major players like Visa, Mastercard, Amazon, and Walmart, among many others, are exploring stablecoin-enabled payments. The field is growing rapidly, with issuers like Tether and Circle Internet Group surpassing $170 billion and $70 billion in U.S. stablecoin issuances, respectively.

Understanding credit risk trends and reporting practices helps institutions maintain clarity in financial decision-making. Institutions are reviewing reserve strategies, refining appraisal approaches, and evaluating reporting structures to align with current expectations and regulatory guidance.

Under ASC 250, changes in accounting estimates have gained prominence following the adoption of the Current Expected Credit Loss (CECL) model. Financial institutions have made various adjustments to their Allowance for Credit Losses (ACL) models, some of which are minor, while others are more substantial. Minor tweaks or improvements to non-key model assumptions may not constitute a change in accounting estimate. However, wholesale changes to core assumptions or frameworks do require formal disclosure.

While materiality of the change is a key consideration, it should not be the sole determinant. Institutions are advised to err on the side of caution and disclose changes when in doubt. If the change in estimate would impact the financial statement reader’s thoughts or interpretations, the changes are best to be disclosed.

Changes in accounting estimates require expanded disclosures in the MD&A section. Institutions should align with current SEC expectations, as SEC comment letters remain a relevant and prevalent topic among registrants. Expanded MD&A disclosures include breaking out loan collateral types by more granular locations. Information about contractual maturities of the loan portfolio is also helpful information to readers of the financials. Narrative context in conjunction with these tables helps provide readers a complete picture of relevant facts about an institution’s loan portfolio.

For CRE lenders operating in distressed markets, it’s important to assess whether market conditions are pervasive across their lending portfolio. Disclosures should reflect institution-specific impacts, offering readers a clear understanding of how market dynamics affect performance.

Finance and accounting teams play an important role in aligning appraisal practices with ACL reporting standards. For collateral-dependent loans, appraisals should generally fall within a 12–18 month window. In recessionary or rapidly changing market environments, appraisals may become outdated more quickly, requiring reassessment. If significant changes occur, ordering a new appraisal is recommended, using sound judgment to balance timing and cost. Allowing appraisals to remain undocumented beyond 18 months introduces risk and may compromise the accuracy of reserve calculations.

Audit red flags in real estate valuation often arise from inconsistencies in key appraisal approaches. When using the income capitalization method, it's important to assess whether comparable properties are reasonable in terms of location, quality, age, and price per square foot. Expense assumptions, such as adjustments for utilities and maintenance, should align with market norms. The sales comparison approach also requires careful evaluation, particularly regarding the proximity of comparable properties and the timing of their last sale. Ultimately, valuation assumptions must be appropriate and supportable, especially when used to determine reserve balances in the individually evaluated portion of the ACL.

Under ASC 860, it is imperative that institutions utilize transaction agreements that meet the standards for sales accounting. Credit enhancements can complicate loan participations transactions, particularly when evaluating whether the enhancement is considered embedded within the loan or a freestanding credit enhancement. Freestanding enhancements, being legally detachable and separately exercisable, are complex and difficult to value, requiring careful consideration under the lens of ASC 326.

On July 15, 2025, the FDIC published a notice of proposed rulemaking that would raise asset thresholds for certain regulatory requirements to better reflect inflation and reduce burdens on community banks.

Future adjustments to the thresholds will be tied to Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), with adjustments occurring every two years or sooner if inflation exceeds 8%.

Comments on the proposal were due by September 26, 2025. Initial changes begin the first calendar quarter after final rule adoption. Future inflationary adjustments will occur every April 1 of the adjustment year.

At Elliott Davis, our Financial Services Group is ready to guide you through:

Whether you're exploring tokenized deposits or preparing for FDIC threshold changes, we’re here to help.

Download our PDF from the webinar, watch the full webinar replay below, or contact our team today to start the conversation.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.