search for solutions by category, industries, insights, and people.

As the world grapples with the urgency of climate change, regulatory frameworks like the SEC's Climate Disclosure proposal and the EU's Corporate Sustainability Reporting Directive (CSRD) are gaining traction. Now, a set of California state laws will have a sweeping effect on climate disclosure standards. These laws will impact and create additional responsibilities for many companies, big and small, well beyond the borders of California.

Continue reading to delve deeper into the implications of these groundbreaking bills, their effective dates, and how they align with global climate disclosure standards.

In September 2023, the California State Assembly passed SB 253 and SB 261, collectively known as the "California Climate Accountability Package." This legislative move sends a clear message to corporations operating in the state: transparency in carbon emissions and climate risks is non-negotiable, and greenwashing will not be tolerated.

Legislation like SB-253 and SB-261 aims to enforce corporate accountability by requiring transparent climate impact assessments and reporting for a broad range of stakeholders. With its standing as the world's fifth-largest economy, California is a significant player on the global stage.

These bills ensure that companies profiting from this lucrative market also take responsibility for their carbon footprint. Given California's global standing, these regulations are set to have a domino effect, influencing corporate behavior not just in the U.S. but globally.

The bill is rooted in California's commitment to climate leadership and the urgent need to mitigate the impacts of climate change. It obliges companies with significant revenue to be transparent about their carbon emissions, aiming to guide California toward a low-carbon economy.

An "emissions reporting organization" will also be contracted by the state by January 1, 2025, to develop a public-facing digital reporting platform funded by annual fees from reporting entities.

Non-compliance will lead to administrative fines, with a maximum limit of $500,000 per year. The state will evaluate the company's compliance history and good faith efforts. Safe harbors protect companies from penalties for reasonable, good-faith misstatements in Scope 3 emissions between 2027 and 2030.

California aims to be a trailblazer by introducing mandatory climate risk disclosure for both public and private entities, recognizing the profound economic and environmental impacts of climate change.

Initially intended for 2024, the bill was amended to start in 2026, in line with SB 253, and will continue biennially.

Non-compliance will lead to administrative penalties, with a maximum fine of $50,000 per reporting year. The state will consider the entity's compliance history and good faith efforts.

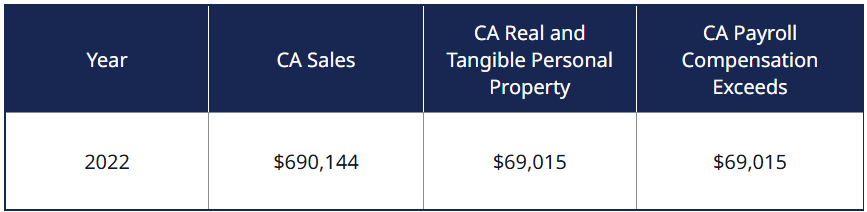

These bills will affect companies doing business in California. California's "doing business" criteria include public and private companies that:

Around 5,400 companies will be directly impacted by both bills, and an additional 5,000 will be affected by SB 261. However, the legislation has implications that go far beyond these figures.

The bills will affect a much larger pool of companies than those directly named as reporting entities. Companies, regardless of size or location, should be ready to provide climate-related data if they are part of these supply chains.

Climate disclosure is becoming more standardized globally. The EU's CSRD is set to have a far-reaching impact, and the SEC's upcoming Climate Disclosure Rule will focus on the largest U.S. publicly traded companies. These regulations are crafted to be interoperable with each other and other global climate regulations, here is how the California bills fit in:

Aligned Objectives: Both California's SB 253 and SB 261 and the SEC's proposed Climate Rule share multiple similarities, primarily in the standards they are built on. Both mandate the disclosure of Scope 1, 2, and 3 emissions according to the Greenhouse Gas Protocol and require climate risk reporting based on TCFD. Additionally, third-party assurance is required by both SB 253 and the SEC proposal.

Distinctive Features: The SEC's rule is confined to publicly traded companies, whereas California's bills extend to any large companies operating within the state. The reporting of Scope 3 emissions is another point of difference, with the SEC's proposal yet to confirm if they will be included or not.

Aligned Objectives: Both the CSRD and California's bills affect both public and private companies within and outside their jurisdictions. They require the reporting of Scope 1, 2, and 3 emissions, climate risks, and third-party verification.

Distinctive Features: The CSRD goes beyond by requiring the disclosure of additional sustainability metrics, including over 100 other ESG indicators.

Compliance with SB 253 and SB 261 not only aligns companies with California's regulations but also positions them well in the context of other major global regulations like the SEC and CSRD.

Governor Newsom's signed these bills into law in early October. The new requirements now take effect on companies starting in 2026.

For many companies, these new requirements are nothing new. However, for others, this is a learning curve. Being proactive is not just about avoiding fines; it’s about preserving your brand’s reputation, which studies show can be more valuable.

If you're questioning your current and future compliance obligations, our team is here to help you prepare.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.