search for solutions by category, industries, insights, and people.

NOTE: this article has been replaced by a more up to date version which includes Senate Draft Proposals. The latest version can be found here.

On the morning of Thursday, May 22, 2025, the U.S. House of Representatives passed President Trump’s expansive tax-and-spending bill by a vote of 215 to 214. After nearly two weeks of negotiations between House Republican factions and resulting modifications to the initial draft of their tax legislation, the One, Big, Beautiful Bill will head to the U.S. Senate for consideration.

Medicaid work requirements, renewable energy provisions, and the cap on the state and local tax deduction (“SALT cap”) were among the key items of contention that certain House Republicans bargained for and revised before the tax-and-spending measure could advance. Specifically, Republican hard-liners who wanted deeper spending cuts negotiated new language that would expedite the termination of former President Biden’s clean energy tax credits. The accelerated phaseouts would generally require clean energy projects to begin construction within 60 days after the bill is enacted or be placed in service before 2029. Also, House members in high-tax states negotiated a raise in the SALT cap from $30,000 in the draft bill to now $40,000, with a phase out for those making more than $500,000.

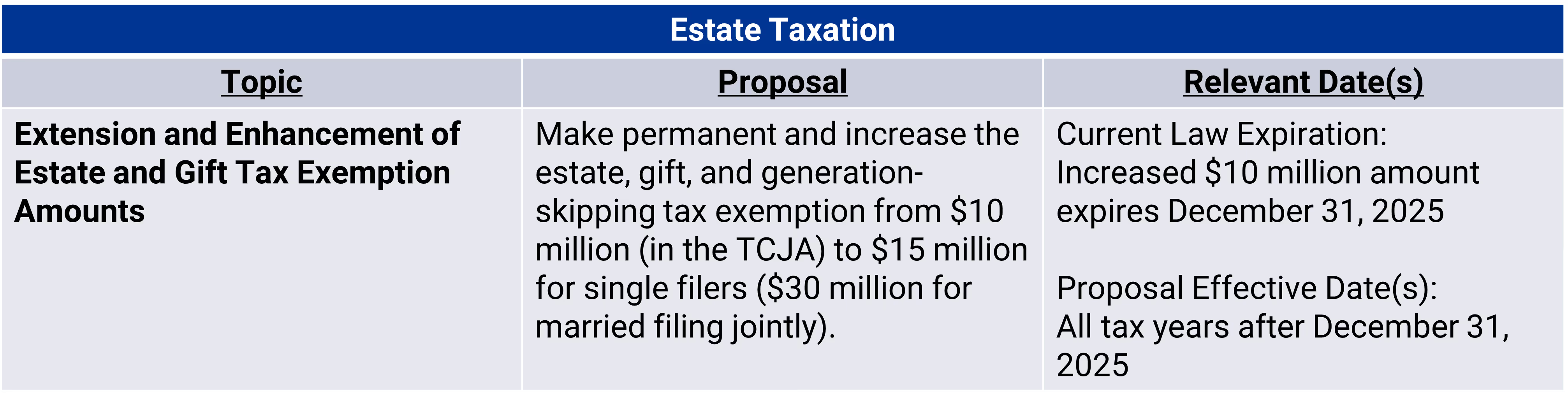

Aside from the hot-button items above, the key provisions introduced in the draft tax package and featured in the final House bill include:

While the final House bill includes a broad set of proposals, it notably omits several anticipated or rumored items, including:

Many Senate Republicans have made clear that they will push for extensive changes before approving a final tax package, and some of the omitted items above could find their way into the Senate’s version of the bill. There are still significant legislative hurdles to overcome in the budget reconciliation process, but the House vote marks an important step toward a bill reaching President Trump’s desk.

As we anticipate any changes brought by the Senate, please consider the following deeper dive into many of the principal proposals, summarized by tax type.

Aside from the key provisions above, the final House bill also includes the following, mostly unchanged from the initial draft tax legislation:

Please note that this alert omits a significant amount of tax provisions featured in the final House bill and that the information provided herein is current as of May 22, 2025. The scope and timing of the Senate’s proposals, or revisions to existing proposals, remains uncertain. We will continue to closely monitor tax bill-related developments and provide updates as new details emerge. If you have any questions about how forthcoming tax legislation may impact you or your business, please consult with your Elliott Davis tax adviser.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.